Attention, dear readers! Have you ever wondered how companies finance their grand projects or expand their operations? In this ever-evolving world of finance, corporate bonds have emerged as a fundamental tool that businesses utilize to secure the much-needed funds. Imagine, if you will, a tool so versatile it can help giants and trailblazers transform ideas into tangible realities.

Read More : Kinerja Emiten Batu Bara Masih Stabil Di Awal Tahun

Enter the world of corporate bonds—a world where opportunity meets strategy, and ambition drives innovation. This financial instrument has been on a notable rise, catching the eyes of investors and analysts alike. As the business landscape redefines itself, both established corporations and emerging players are turning to bond issuance to navigate their financial futures. Curious to know more about this significant surge in corporate bond issuance? Let’s dive in!

The Rise of Corporate Bond Issuance

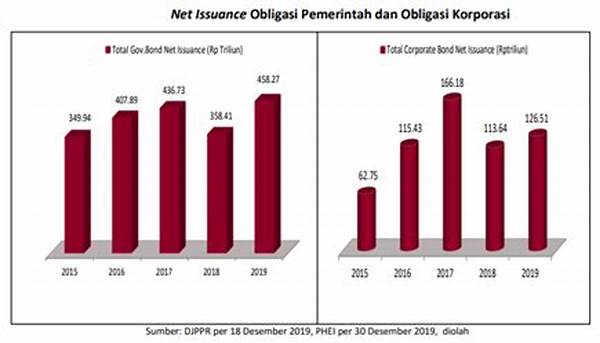

Over recent years, the trend of corporate bond issuance has experienced a remarkable upswing. This trend, akin to a blockbuster’s opening weekend at the box office, has financial markets buzzing with anticipation and intrigue. According to recent statistics, corporate bond issuance has not only grown in volume but has also diversified across industries and geographies. The surge, as exciting as a rollercoaster ride, is driven by several factors, including low-interest rates and a growing appetite for new capital from companies eager to expand and innovate.

The Factors Behind the Boom

Several underlying dynamics contribute to the increased issuance of corporate bonds. Firstly, the prolonged period of low-interest rates has made borrowing through bonds more attractive than ever. Companies are capitalizing on favorable financing conditions to drive their ambitious agendas. Secondly, the rising demand from investors searching for stable returns in a volatile market landscape has provided a conducive environment for more corporations to issue bonds. As investors clamor for these bonds, companies see an opportunity to secure funds at competitive rates, fueling further growth.

The Benefits of Corporate Bonds

Corporate bonds offer a unique proposition for both issuers and investors. For companies, bonds provide a way to raise substantial sums of money without diluting ownership through equity issuance. It’s like choosing a dessert that fits your diet plan—focused, effective, and rewarding. For investors, these bonds represent an opportunity to earn a steady income while diversifying their investment portfolios. The symbiotic relationship is akin to an expertly choreographed dance, where every move is calculated yet fluid.

Why Corporates Are Issuing More Bonds

The compelling rise in corporate bond issuance is best explained through a blend of economic, strategic, and market-driven motives.

Investor Attraction

From an investor’s perspective, bonds have become increasingly appealing given their potential for stable returns. As companies bolster their financial strategies with bond issuance, investors have responded enthusiastically. Driven by the promise of consistent income and reduced risk, bonds offer a financial oasis in the desert of erratic market movements.

Understanding Corporate Bond Issuance

To scratch beneath the surface of this trend, it’s essential to understand the nuances and strategies involved in corporate bond issuance. Picture the scene: a company that needs financing for a new project weighs its options—and bonds emerge as a strategic instrument.

Making the Decision

The decision to issue a corporate bond involves weighing various options, assessing market conditions, and calculating potential returns. The move has to be as calculated as a chess game, where every step carries potential benefits and risks.

Conclusion: The Future of Corporate Bond Issuance

As we reflect on the current corporate bond landscape, it’s clear that the surge in issuance is more than just a fleeting trend. It’s a testament to the adaptability and strategic prowess of corporations navigating complex financial terrains. As global markets continue to evolve, it’s intriguing to speculate about the future of corporate bonds.

The combination of favorable economic conditions, strategic corporate goals, and investor demand suggests that corporate bond issuance will likely remain a pivotal part of the financial ecosystem. It’s a world where numbers tell stories, strategies map the future, and markets hum with potential—a true testament to the dynamic world of finance.

This uptrend in corporate bond issuance represents not just a surge in numbers but a significant shift in how modern businesses finance their tomorrow. With eyes set on growth and opportunities aligned, companies are rewriting financial narratives, one bond at a time.